Gift Tax Rules 2025. How much money can i gift my children? Recent cca raises concerns for irrevocable grantor trust modifications.

Gifts in other cases are taxable. Any tax due is determined after applying a credit based on an applicable exclusion amount.

The annual gift tax exclusion for 2025 sets limits on how much you can give to an individual without triggering federal gift tax.

For example, a man could give $18,000 to each of his 10 grandchildren this year with no gift tax implications.

IRS releases proposed gifttax rules that would benefit wealthy, How do estate and gift taxes actually work? For 2025, the annual gift tax exclusion is $18,000, up from $17,000 in 2025.

We Explain Gifts and Gift Tax Rules Tucson Elder Law Attorney, Who you give the gift to and their relationship to you. Learn about gifting a property, gift tax rates, exemptions, and the tax implications on monetary gifts.

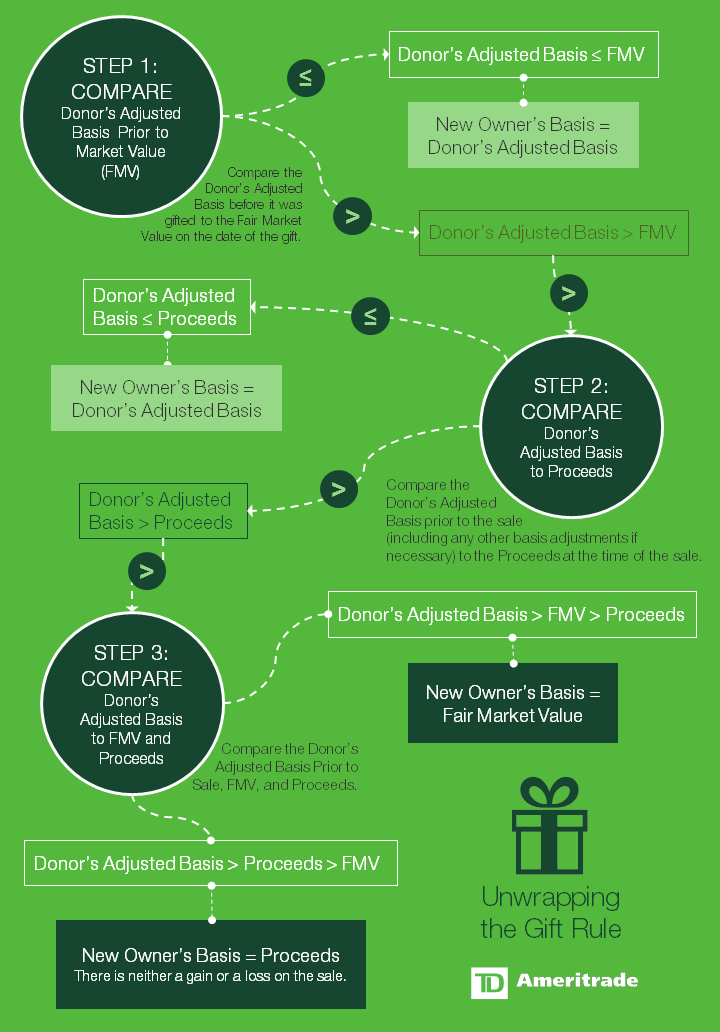

Gift Tax Rules Simplified Cost Basis of Gifted Stock Ticker Tape, The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. What are potentially exempt transfers?

Gift Tax Rates 2025 Franni Clarice, Learn about rules and exemptions. Eric lee/the new york times.

How do U.S. Gift Taxes Work? IRS Form 709 Example YouTube, The transfer is made voluntarily. What are potentially exempt transfers?

Gift Tax rules for US citizens (Guidelines) Expat US Tax, Who you give the gift to and their relationship to you. Recent cca raises concerns for irrevocable grantor trust modifications.

A Comprehensive Guide to Understanding the Gift Tax Inflation Protection, This means you can give up to $18,000 to as many people as you want in 2025 without any of it being subject to the federal gift tax. The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2025.

Gift Tax in India Part 1 All About Gift Tax Rules & Exemptions Gift, The annual gift tax exclusion for 2025 sets limits on how much you can give to an individual without triggering federal gift tax. The parliament of india introduced the gift tax act in 1958, and gift tax is essentially the tax charged on the receipt of gifts.

What you need to know about the Gift Tax Marketing by Numbers, July 4, 2025 at 6:52 am pdt. We define a gift with the following criteria:

New gift tax rules to impact the Bank of Mum and Dad, Both of these tax areas offer certain opportunities for reducing tax liability, and knowing how to take advantage of these can be a significant benefit. Annual federal gift tax exclusion.